nebraska inheritance tax rates

All Major Categories Covered. Close relatives of the deceased person are given a 40000 exemption from the state inheritance tax.

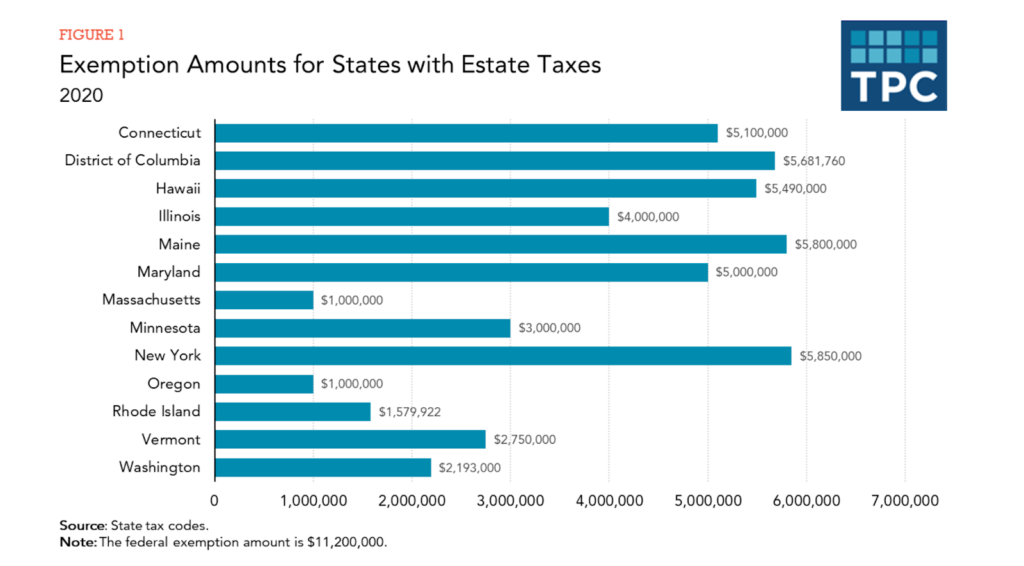

State Estate And Inheritance Taxes Itep

Nebraska Inheritance Tax Update CAP Series 22-0304 Center for Agricultural Profitability University of Nebraska-Lincoln March 8.

. Life EstateRemainder Interest Tables REG-17-001 Scope Application and Valuations 00101 Nebraska inheritance tax applies to bequests devises or transfers of property or any other interest in trust or otherwise having characteristics of annuities life estates terms for years remainders or reversionary interests. 5 rows Nebraska Inheritance Tax. The burden of paying Nebraskas inheritance tax ultimately falls upon those who inherit the property not the estate.

Nebraska inheritance tax form 500 like an iPhone or iPad easily create electronic signatures for signing a nebraska inheritance tax worksheet 2021 in PDF format. There are only six states in the nation that levy an inheritance tax and Nebraska is one of them. For states to immediately amend their inheritance tax laws into progressive structures and many states that had not yet levied the tax added it to their tax rolls.

Clear market value is measured by the fair market value of the property as of the date of the death of the grantor less the consideration paid for the property. Inheritance Tax Rates by State Ranked by Bracket ChildRateNephewNiece Non-RelativeRate Rate 1. In re Estate of Craven 281 Neb.

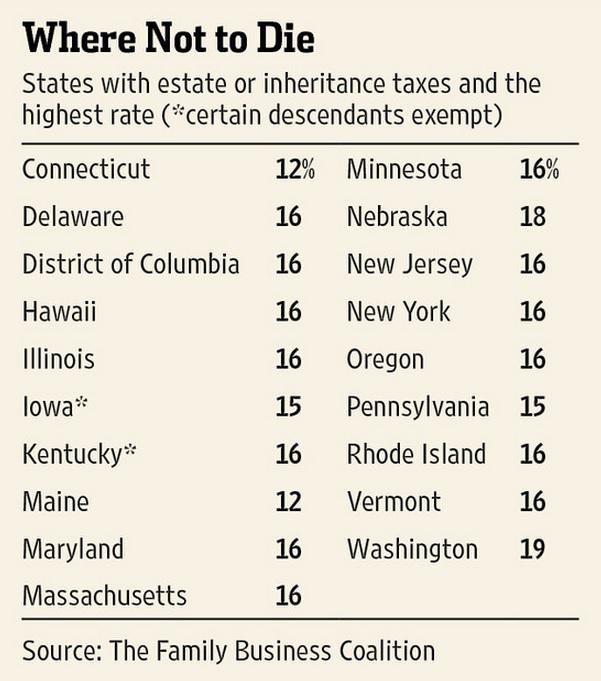

The surviving spouse of the person who has died pays no inheritance tax and beginning January 1 2023 anyone under age 22 pays no inheritance tax. N Nebraska is the only state to use inheritance tax as a local revenue source and has the nations highest tax rate at 18. N The inheritance tax is inequitable.

Nebraska inheritance tax is computed on the fair market. Transfers to immediate family members other than the surviving spouse -- The tax rate on transfers to immediate relatives eg children grandchildren siblings parents etc will remain 1 however the exemption amount will increase from 40000 to 100000 per beneficiary. SignNow has paid close attention to iOS users and developed an application just for them.

Beyond that the Nebraska inheritance tax is as follows. Here is an example. Nebraska is one of only six states that levy inheritance taxes and one of the six Iowa will phase out its tax by 2025.

122 794 NW2d 406 2011. Of the six states that currently impose inheritance taxes only two states Nebraska and Pennsylvania have chosen to tax lineal heirs children and grandchildren while the others exempt these relatives. In other words they dont owe any tax at all unless they inherit more than 40000.

Generally inheritance taxes are paid to the county or counties where the inherited property is located. Nebraska inheritance tax rates If you were the decedents parent grandparent sibling child. According to a local law firm When a person dies a resident of Nebraska or with property located in Nebraska the Nebraska county inheritance tax will likely apply to the decedents property.

The tax has a series of ascending tax rates with a top rate of 40. Select Popular Legal Forms Packages of Any Category. Other Transfers All other beneficiaries receive a 10000 exemption and property valued over the exempt amount is subject to an 18 tax.

Until this TABLE 1. Close relatives pay 1 tax after 40000. To find it go to the AppStore and type signNow in the search field.

This class receives a 15000 exemption and property valued over the exemption is subject to a 13 tax. Higher tax burdens can be imposed depending on the family structure or relationship of a decedent and heir. So we pay county inheritance taxes when we inherit property in Nebraska.

That exemption amount and the underlying inheritance tax rate varies based on the inheritance. A practitioner should also note that for inheritance tax purposes Nebraska law will treat as a child of the decedent any person to whom the deceased for not less than 10 years prior to. The inheritance tax must be paid within 12 months of the date of death otherwise interest accrues at 14 with penalties of 5 per month up to 25 of the tax due.

Generally property may not be inherited until the inheritance tax is paid. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Nebraska currently has the nations top inheritance tax rate 18 on remote relatives and non-related heirs.

In fact Nebraska has the highest top rate at 18. Beneficiaries inheriting property pay an inheritance tax over the value that exceeds their exemption amount which ranges between 10000 and 40000. But there are two important exceptions.

First you take out the exemption of 1206 million leaving a taxable estate of 782 million. LB310 - Change inheritance tax rates inheritance tax exemption amounts and individuals who are considered relatives of a decedent. Tax Rates and Exemptions.

Say your estate is worth 1988 million and you are not married. N Inherited property worth just over 10000 can become subject to the tax. If they inherit more than 40000 a 1 tax will apply to the amount over the first 40000.

An inheritance by the widower of a daughter is not taxable at the rate prescribed by this section. Politics Proposed 4000-acre lake between Omaha and Lincoln could cost. For all other beneficiaries Class 3 the rate of tax is 18 percent on the value of the property in excess of 10000.

States That Won T Tax Your Retirement Distributions Income Tax Income Tax

Feeling The Squeeze The Negative Effects Of Eliminating Nebraska S Inheritance Tax Open Sky Policy Institute

All You Need To Now About Inheritance Taxes At Federal And State Level

The Death Tax Taxes On Death American Legislative Exchange Council

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Bill To Cut Inheritance Tax Rates Increase Exemptions Advanced Unicameral Update

Estate Inheritance And Gift Taxes In Connecticut And Other States

Washington State Inheritance Tax What You Need To Know The Harbor Law Group

How Much Is Inheritance Tax Community Tax

Estate And Inheritance Tax Coyle Financial

How Much Is Inheritance Tax Community Tax

State Estate And Inheritance Taxes

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Estate Tax Inheritance Tax Arizona Real Estate

Does Nebraska Have An Inheritance Tax Hightower Reff Law

Calculating Inheritance Tax Laws Com

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Estate Tax Inheritance Tax Arizona Real Estate